Wealthfront is an online financial planner that lets users build a path to reach their financial goals. With the Path feature, users can track their progress towards achieving goals through embedded graphs and charts. You can run different scenarios and get updated guidance. You can also customize your portfolio and get cash management.

Investing low-cost in exchange traded funds

There are many benefits to investing in low-cost exchange traded funds (ETFs). These funds offer lower average costs. In contrast to buying individual stocks, where investors have to make multiple trades, an ETF requires just one transaction to buy or sell shares. Brokers are paid fewer commissions and fees. Second, many low cost ETFs also pay dividends. These dividends can be reinvested, which will reduce your overall cost.

Investors who want to have a diverse portfolio of stocks and bonds can also use low-cost exchange trade funds. These funds can be used to mimic the S&P 500 or other segments of the market. They can also be purchased at lower prices than individual stocks.

Tax-loss harvesting

Wealthfront's tax-loss harvesting capabilities allow users to maximize aftertax returns on their investments. The company makes use of a computer program to optimize a portfolio and capture investment losses. This is then used to reduce tax liability. The service is limited to taxable accounts. A minimum base account balance must be $500.

Although automatic tax-loss harvesting software can identify clients, it isn't foolproof. Inadvertent sales of wash products can lead to losses that cannot be reclaimed, which can have a major impact on your tax bill.

Portfolio line of credit

A Wealthfront Portfolio Line of Credit is a great option to borrow money for your investment needs. This type of loan allows people with an account balance of at least $25,000 to borrow up to 30% of that amount without going through a credit check. The interest rates on this loan are typically lower than home equity lines of credit and you can choose your repayment schedule. Remember that the interest on money you borrow is accrued until you pay it back in full. You may need to liquidate some of your account money if you have more $25,000 in a taxable brokerage account.

The Wealthfront portfolio line of credit has an interest rate of 3.25% - 4.5%. This is significantly less than what credit card companies and banks charge. The process is quicker than a HELOC as well as costing less than a private manager. If you are worried about your credit score you might consider looking into other options.

A free digital tool for financial planning

Wealthfront is a new platform that provides financial advice and top-notch financial planning for all investors. Wealthfront's team has extensive financial experience. Their chief investment officer wrote "A Random Walk Down Wall Street", which popularized passive investing. Wealthfront's online investment tool lets you enter your financial information and pick an investment goal. The tool will then analyze the financial information to suggest investment strategies.

Wealthfront has some unique features that set it apart from other roboadvisors. First, you can easily register. Wealthfront will ask you several questions about your goals, risk tolerance, and other details after you've signed up. Your answers will be recorded in your portfolio, which you can change if you change your mind or want to make adjustments. You can also import your portfolio from your broker. Wealthfront eventually allows you to own individual stocks. This means that you can direct how your money invests.

FAQ

What are the Different Types of Investments that Can Be Used to Build Wealth?

You have many options for building wealth. Here are some examples:

-

Stocks & Bonds

-

Mutual Funds

-

Real Estate

-

Gold

-

Other Assets

Each has its benefits and drawbacks. Stocks and bonds are easier to manage and understand. However, they are subject to volatility and require active management. Real estate, on the other hand tends to retain its value better that other assets like gold or mutual funds.

It all comes down to finding something that works for you. The key to choosing the right investment is knowing your risk tolerance, how much income you require, and what your investment objectives are.

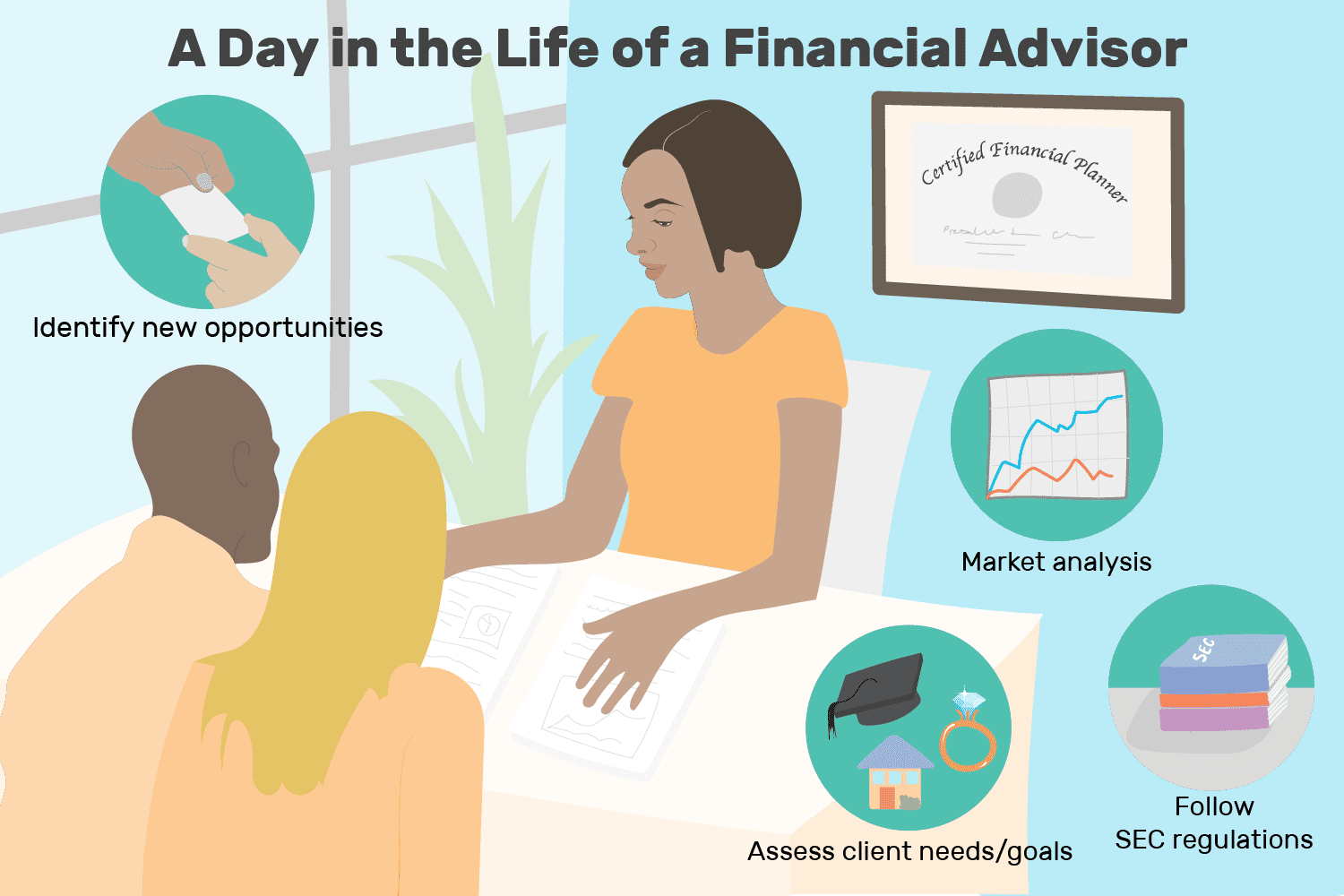

Once you have chosen the asset you wish to invest, you are able to move on and speak to a financial advisor or wealth manager to find the right one.

How does Wealth Management work?

Wealth Management allows you to work with a professional to help you set goals, allocate resources and track progress towards reaching them.

Wealth managers not only help you achieve your goals but also help plan for the future to avoid being caught off guard by unexpected events.

These can help you avoid costly mistakes.

Where To Start Your Search For A Wealth Management Service

You should look for a service that can manage wealth.

-

A proven track record

-

Is it based locally

-

Consultations are free

-

Continued support

-

Has a clear fee structure

-

Reputation is excellent

-

It is easy to contact

-

Customer care available 24 hours a day

-

Offers a range of products

-

Low charges

-

There are no hidden fees

-

Doesn't require large upfront deposits

-

Make sure you have a clear plan in place for your finances

-

Transparent approach to managing money

-

It makes it simple to ask questions

-

Does your current situation require a solid understanding

-

Understand your goals & objectives

-

Is willing to work with you regularly

-

Work within your budget

-

Has a good understanding of the local market

-

We are willing to offer our advice and suggestions on how to improve your portfolio.

-

Is available to assist you in setting realistic expectations

Statistics

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

- Newer, fully-automated Roboadvisor platforms intended as wealth management tools for ordinary individuals often charge far less than 1% per year of AUM and come with low minimum account balances to get started. (investopedia.com)

External Links

How To

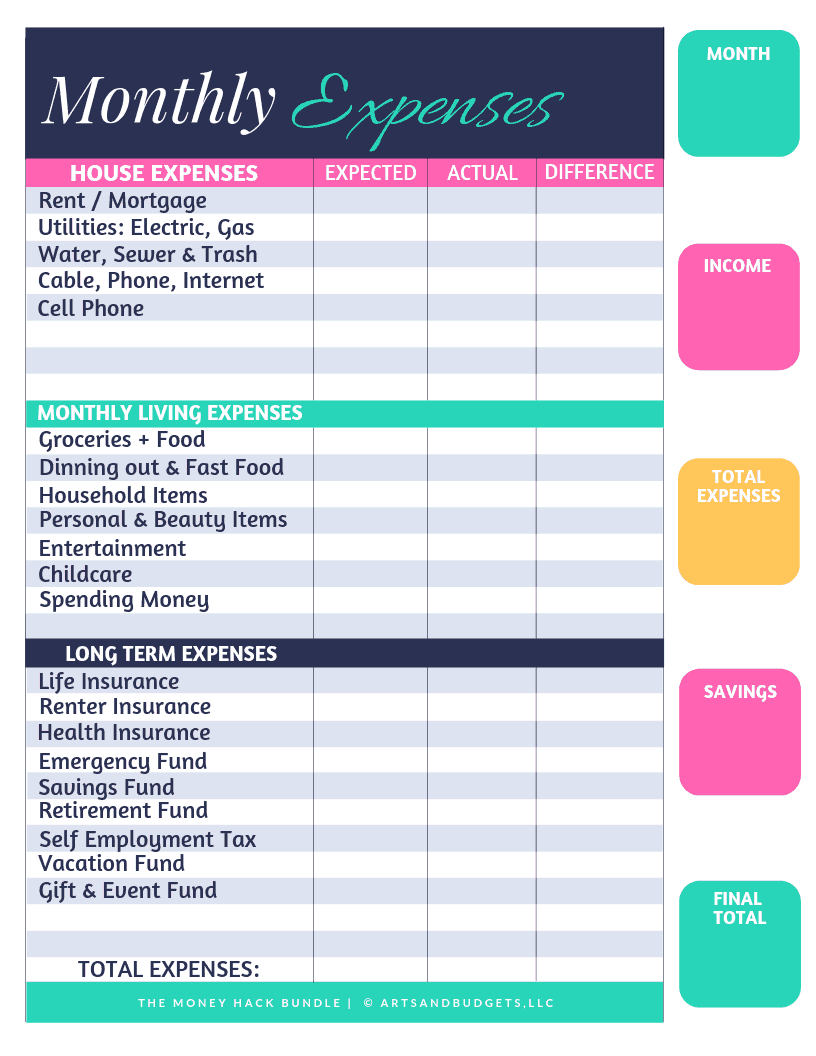

How to save on your salary

It takes hard work to save money on your salary. These steps will help you save money on your salary.

-

You should get started earlier.

-

It is important to cut down on unnecessary expenditures.

-

Online shopping sites like Flipkart, Amazon, and Flipkart should be used.

-

Do your homework at night.

-

You must take care your health.

-

Your income should be increased.

-

You should live a frugal lifestyle.

-

You should be learning new things.

-

You should share your knowledge with others.

-

Books should be read regularly.

-

Rich people should be your friends.

-

You should save money every month.

-

It is important to save money for rainy-days.

-

It is important to plan for the future.

-

Time is not something to be wasted.

-

Positive thinking is important.

-

Avoid negative thoughts.

-

God and religion should always be your first priority

-

Good relationships are essential for maintaining good relations with people.

-

Your hobbies should be enjoyed.

-

It is important to be self-reliant.

-

Spend less than you earn.

-

It is important to keep busy.

-

You must be patient.

-

Always remember that eventually everything will end. It's better to be prepared.

-

You shouldn't ever borrow money from banks.

-

Try to solve problems before they appear.

-

It is a good idea to pursue more education.

-

You need to manage your money well.

-

Honesty is key to a successful relationship with anyone.