As a single mother, the first step to budgeting is to set up savings accounts for you and your children. This will allow you to save money long-term for goals and help plan for the next. You can save even a little money each month and it will add up over the long-term. It is important to create a personal financial plan.

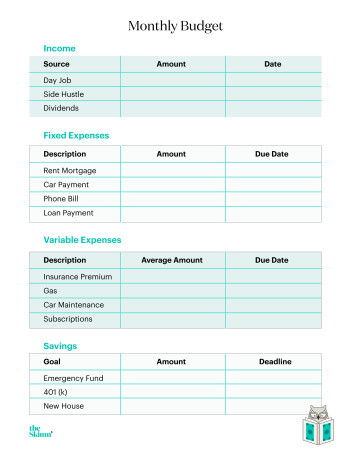

Tracking expenses for a single mom

It is essential to track your expenses as a single mother in order to establish a realistic budget. Whatever system you use, it's important to keep track of each penny. This can help you reduce unnecessary expenses and make a budget you can keep to. It is also useful to track your monthly expenses. You must also take into consideration your lifestyle and the needs for your children. You can request that the other parent cover some of the cost of essentials for your children if this is possible. If they are unable to pay, you can negotiate a child support agreement.

You may be a single mother and have fewer resources or higher expenses. You may need to hire a nanny or use childcare, which adds to your budget. To cover these expenses you may also need an increase in your income. A winning budget is a way to make your life easier and ensure financial security.

Establishing an emergency fund

It can be hard to save money for an emergency, but it is important to have a plan. Clear goals will help you keep on track and make it easier for you to stick to your plan. For example, you could create an emergency fund with three to six months worth of expenses. You can save some money each month, and then increase it over time. A savings planning tool will be helpful to determine the time it will take to achieve your goal.

One of the most important aspects of budgeting is to create an emergency fund. An emergency fund will enable you to cover unexpected expenses and avoid going into debt. You will feel more secure. You should have at least $500 in emergency funds. You should have enough money to cover the cost of a credit card.

How to create a personal budget

A budget is essential, especially for single mothers with low income. A budget will help you plan ahead and better understand your finances. Child support and alimony are only two options. This budget helps you avoid financial stress and manage your finances yourself.

A sinking fund is a savings account that you can use to pay for large expenses when you run out of money. For instance, you can set up a fund for holiday gifts, family vacations, or summer camp tuition. You can also establish a 529 college savings program to help save for your child’s education. These expenses are difficult to pay for when you're in debt. Therefore, you should have a plan to create a budget and stick with it.

Realistic financial goals

To ensure your children's comfort, you need to set realistic financial goals. You can track your expenses to help you do this. You should know how much money you are spending each month, and what you can live without. This will help you stay within your budget and model good financial behavior for your children.

It is important to save money for unexpected expenses. You may not have the extra income of your partner, but it is smart to have a plan just in case. This will allow you to save up money and also give you more options. Bad things are inevitable, but you can minimize them if you plan for them.

FAQ

What is estate planning?

Estate Planning is the process of preparing for death by creating an estate plan which includes documents such as wills, trusts, powers of attorney, health care directives, etc. These documents serve to ensure that you retain control of your assets after you pass away.

How to Beat Inflation With Savings

Inflation refers to the increase in prices for goods and services caused by increases in demand and decreases of supply. Since the Industrial Revolution, when people started saving money, inflation was a problem. The government regulates inflation by increasing interest rates, printing new currency (inflation). But, inflation can be stopped without you having to save any money.

Foreign markets, where inflation is less severe, are another option. There are other options, such as investing in precious metals. Because their prices rise despite the dollar falling, gold and silver are examples of real investments. Investors who are concerned by inflation should also consider precious metals.

What Are Some Benefits to Having a Financial Planner?

A financial plan is a way to know what your next steps are. You won't have to guess what's coming next.

It gives you peace of mind knowing that you have a plan in place to deal with unforeseen circumstances.

Your financial plan will also help you manage your debt better. A good understanding of your debts will help you know how much you owe, and what you can afford.

Your financial plan will help you protect your assets.

Who can I turn to for help in my retirement planning?

Many people find retirement planning a daunting financial task. This is not only about saving money for yourself, but also making sure you have enough money to support your family through your entire life.

Remember that there are several ways to calculate the amount you should save depending on where you are at in life.

If you're married, you should consider any savings that you have together, and make sure you also take care of your personal spending. If you are single, you may need to decide how much time you want to spend on your own each month. This figure can then be used to calculate how much should you save.

You can save money if you are currently employed and set up a monthly contribution to a pension plan. Another option is to invest in shares and other investments which can provide long-term gains.

Talk to a financial advisor, wealth manager or wealth manager to learn more about these options.

Who Should Use A Wealth Manager?

Anyone who wants to build their wealth needs to understand the risks involved.

People who are new to investing might not understand the concept of risk. Poor investment decisions can lead to financial loss.

This is true even for those who are already wealthy. They might feel like they've got enough money to last them a lifetime. But they might not realize that this isn’t always true. They could lose everything if their actions aren’t taken seriously.

Therefore, each person should consider their individual circumstances when deciding whether they want to use a wealth manger.

What are the advantages of wealth management?

Wealth management has the main advantage of allowing you to access financial services whenever you need them. It doesn't matter if you are in retirement or not. You can also save money for the future by doing this.

To get the best out of your savings, you can invest it in different ways.

You could invest your money in bonds or shares to make interest. You can also purchase property to increase your income.

A wealth manager will take care of your money if you choose to use them. You don't have to worry about protecting your investments.

Statistics

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

External Links

How To

How to become a Wealth Advisor?

A wealth advisor can help you build your own career within the financial services industry. There are many career opportunities in this field today, and it requires a lot of knowledge and skills. These qualities are necessary to get a job. Wealth advisors have the main responsibility of providing advice to individuals who invest money and make financial decisions based on that advice.

Before you can start working as wealth adviser, it is important to choose the right training course. It should include courses such as personal finance, tax law, investments, legal aspects of investment management, etc. Once you've completed the course successfully, your license can be applied to become a wealth advisor.

Here are some tips on how to become a wealth advisor:

-

First, you must understand what a wealth adviser does.

-

You need to know all the laws regarding the securities markets.

-

It is important to learn the basics of accounting, taxes and taxation.

-

After finishing your education, you should pass exams and take practice tests.

-

Finally, you will need to register on the official site of the state where your residence is located.

-

Get a work license

-

Give clients a business card.

-

Start working!

Wealth advisors can expect to earn between $40k-60k a year.

The size of the business and the location will determine the salary. The best firms will offer you the highest income based on your abilities and experience.

Summarising, we can say wealth advisors play an essential role in our economy. Everyone should be aware of their rights. Additionally, everyone should be aware of how to protect yourself from fraud and other illegal activities.