A career as a financial adviser may be ideal for you if you are a people person and have a keen interest in finance. You must have specialized training in order to provide financial advice. However, before you begin pursuing your dream job, make sure you know exactly what it entails. This section will give you an overview about this career path. These are some things to keep in mind:

Work environment

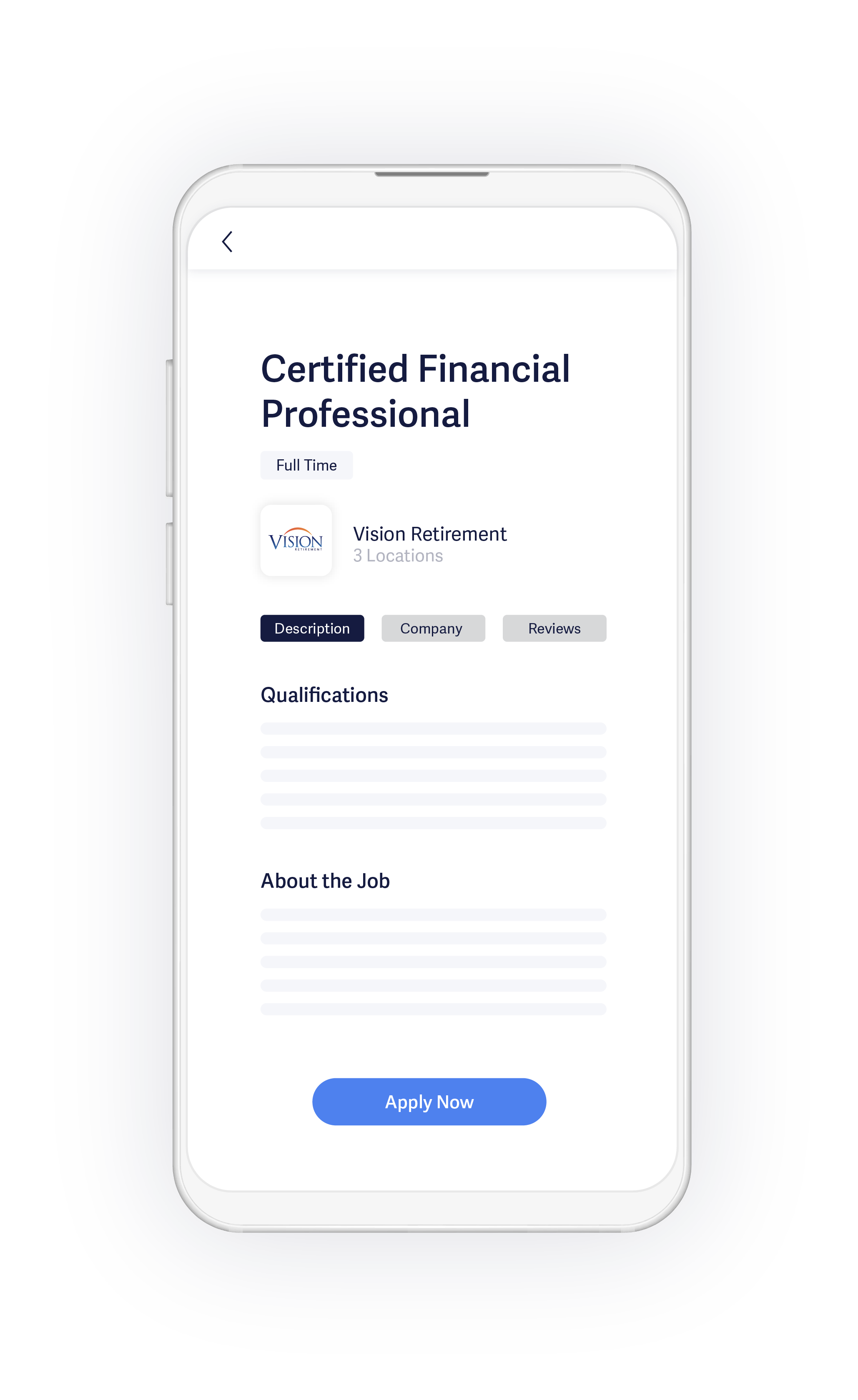

A financial advisor's work environment can vary from one company to the next. Many financial advisors work 40-hour weeks, while others work weekends. Some firms will also hire finance interns. Financial industry associations have a variety of programs that can help advisors expand their client base. Many advisors begin their career working for their companies, but it is possible to apply directly for jobs through their websites. Before applying to any of the firms, please upload your resume.

Some retail banks offer graduate-training programs, while some recruit graduates directly. Experienced financial sales professionals can also apply for other jobs. Financial advisers can start in banks and other financial service firms. A driving license may be an asset. It is also helpful to have some experience in customer service, sales, and other areas. However, a postgraduate degree does not necessarily mean you are qualified. You can even be a paraplanner in order to support advisors.

Education requirements

If you're interested a career as financial advisor, a college diploma in finance or business administration is recommended. This degree will provide you with strong foundational skills in business and finance, and prepares you for large-scale management roles or projects. You will also be able to lead and conduct research. A degree in general business administration or business administration will help you to build a strong background in finance. It may even be enough for you to get a job as financial advisor or manager.

Although you can become a financial adviser without a degree most positions require one. If you choose to go on an undergraduate program, make sure you select a finance major like accounting or economics. You'll be learning about financial planning, investment theory and business ethics as an undergraduate. To help you study for the exam, you can take courses in estate planning, risk management, and estate planning.

Potential earnings

It's easy to see why financial advisors could be a highly lucrative career. Advisors typically work with between 100 and 150 clients. That would translate into approximately one hundred to twenty hours per week or roughly two days. Advisors would also need to be operational and administrative. They'd also need to train employees or handle other business issues.

The Bureau of Labor Statistics monitors the salaries of financial planners. Financial advisors are most likely to live in large metropolitan areas such as Baltimore or Salisbury. In contrast, less than 100 of these financial advisors are located in smaller metropolitan areas. This is due to a greater number of financial advisors per person, better networking opportunities, and competition for clients. Baltimore's average financial advisor earns $96K annually, while incomes are near the top of a 90th percentile at $200K.

Flexible work hours

Financial advisors are typically expected to work a certain schedule. Today's financial planning and advisory jobs can be more flexible than traditional ones. Tied adviser positions at banks and financial institutions have regular office hours. However, private banking jobs often require flexibility. IFAs can meet clients at home, in addition to their regular office hours. Private banking positions are mostly based in London but some require overnight accommodations. This is why flexibility is so important in this field.

While the average income for a financial advisor is more than $90,000., many make much more. It is common to earn high incomes in financial planning by working with commission products and fees-based services. Many people choose to become financial advisors because of the low start-up costs and flexible hours. According to Bureau of Labor Statistics, financial advisors are expected to grow 15% over the next decade. This surpasses the average 7% annual growth rate of all occupations. As baby boomers get older, so will the need for financial advice.

FAQ

What is investment risk management?

Risk Management refers to managing risks by assessing potential losses and taking appropriate measures to minimize those losses. It involves the identification, measurement, monitoring, and control of risks.

A key part of any investment strategy is risk mitigation. Risk management has two goals: to minimize the risk of losing investments and maximize the return.

These are the core elements of risk management

-

Identifying sources of risk

-

Measuring and monitoring the risk

-

Controlling the Risk

-

How to manage risk

How do I start Wealth Management?

The first step towards getting started with Wealth Management is deciding what type of service you want. There are many Wealth Management service options available. However, most people fall into one or two of these categories.

-

Investment Advisory Services- These professionals will help determine how much money and where to invest it. They can help you with asset allocation, portfolio building, and other investment strategies.

-

Financial Planning Services - A professional will work with your to create a complete financial plan that addresses your needs, goals, and objectives. He or she may recommend certain investments based on their experience and expertise.

-

Estate Planning Services- An experienced lawyer will help you determine the best way for you and your loved to avoid potential problems after your death.

-

Ensure that a professional is registered with FINRA before hiring them. You can find another person who is more comfortable working with them if they aren't.

How to Choose an Investment Advisor

The process of selecting an investment advisor is the same as choosing a financial planner. There are two main factors you need to think about: experience and fees.

It refers the length of time the advisor has worked in the industry.

Fees refer to the costs of the service. These fees should be compared with the potential returns.

It is important to find an advisor who can understand your situation and offer a package that fits you.

What Are Some Benefits to Having a Financial Planner?

A financial plan will give you a roadmap to follow. You won't be left guessing as to what's going to happen next.

It will give you peace of heart knowing you have a plan that can be used in the event of an unexpected circumstance.

Financial planning will help you to manage your debt better. A good understanding of your debts will help you know how much you owe, and what you can afford.

Your financial plan will protect your assets and prevent them from being taken.

Who can help with my retirement planning

Retirement planning can be a huge financial problem for many. Not only should you save money, but it's also important to ensure that your family has enough funds throughout your lifetime.

The key thing to remember when deciding how much to save is that there are different ways of calculating this amount depending on what stage of your life you're at.

If you're married you'll need both to factor in your savings and provide for your individual spending needs. You may also want to figure out how much you can spend on yourself each month if you are single.

You could set up a regular, monthly contribution to your pension plan if you're currently employed. Another option is to invest in shares and other investments which can provide long-term gains.

Contact a financial advisor to learn more or consult a wealth manager.

What are some of the best strategies to create wealth?

Your most important task is to create an environment in which you can succeed. You don't want the burden of finding the money yourself. If you aren't careful, you will spend your time searching for ways to make more money than creating wealth.

Additionally, it is important not to get into debt. It is tempting to borrow, but you must repay your debts as soon as possible.

You set yourself up for failure by not having enough money to cover your living costs. When you fail, you'll have nothing left over for retirement.

It is important to have enough money for your daily living expenses before you start saving.

How old can I start wealth management

Wealth Management is best when you're young enough to reap the benefits of your labor, but not too old to lose touch with reality.

The sooner you invest, the more money that you will make throughout your life.

You may also want to consider starting early if you plan to have children.

Savings can be a burden if you wait until later in your life.

Statistics

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

External Links

How To

How to become Wealth Advisor

Wealth advisors are a good choice if you're looking to make your own career in financial services and investment. This job has many potential opportunities and requires many skills. These are the qualities that will help you get a job. A wealth advisor is responsible for giving advice to people who invest their money and make investment decisions based on this advice.

The right training course is essential to become a wealth advisor. It should cover subjects such as personal finances, tax law, investments and legal aspects of investment management. After you complete the course successfully you can apply to be a wealth consultant.

Here are some tips on how to become a wealth advisor:

-

First, it is important to understand what a wealth advisor does.

-

You should learn all the laws concerning the securities market.

-

It is essential to understand the basics of tax and accounting.

-

After completing your education, you will need to pass exams and take practice test.

-

Final, register on the official website for the state in which you reside.

-

Get a work license

-

Show your business card to clients.

-

Start working!

Wealth advisors are typically paid between $40k-60k annually.

The size and location of the company will affect the salary. If you want to increase income, it is important to find the best company based on your skills and experience.

In conclusion, wealth advisors are an important part of our economy. Everybody should know their rights and responsibilities. Moreover, they should know how to protect themselves from fraud and illegal activities.