Fee-only financial planners are paid only by their clients. This means they don't make extra money. A fee-only financial advisor can provide advice on any topic that you might need, such as investing in stocks or planning your retirement. This type of planner may not be suitable for everyone. Find out why. Additionally, fee-only financial advisors tend to be more qualified and offer higher levels of service.

Clients pay a fee-only financial advisor

Financial planners who charge a fee only earn their income directly from clients and don't accept commissions from any third party. They are therefore incented to work in the best interests of their clients. They also have to adhere to a fiduciary code. As such they are more likely be to have a broad grasp of a range of financial products. This allows them to offer clients the best possible financial advice.

They don’t make side income.

Financial planners who charge a fee only are not commission-based. This arrangement means that their only source of income is from the money their clients pay them for their services. Instead of making money on commissions, they base their advice on their clients' best interests. Some consumers are unsure if financial planners really serve their best interests, despite the fact that they can sell well.

They charge transparent charges

A fee-only financial advisor has many benefits. The fees charged by these planners are transparent as they do not receive any commissions or referral fees. They are affordable for those with low assets and are therefore not too expensive. Financial planners who charge a fee are not tied to any particular company. They can therefore offer their clients a broad range of options. They do not have conflicts of interest to worry about.

They can give advice on just about any topic

Unlike other types of financial advisers, fee only financial planners do not receive referral fees or commissions for recommending specific products. These advisors are usually fee-only and can provide advice on almost all topics, including investment strategy and tax planning. They may also offer you advice on estate planning matters. They don't charge for an initial consultation. Instead, their fees are based upon the income they earn.

They can be costly.

People often wonder if fee-only financial planners are worth it. Although fee-only financial professionals don't have sales incentives, it is important to know that they may not be the best fit for you. But fee-only planning can have many benefits. These advisors can help improve your financial future, reduce tax burdens, and reward your employees. Fee-only financial planners can also review your debt and help you understand what's going on with it.

FAQ

What are the advantages of wealth management?

The main benefit of wealth management is that you have access to financial services at any time. It doesn't matter if you are in retirement or not. If you are looking to save money for a rainy-day, it is also logical.

You can invest your savings in different ways to get more out of it.

To earn interest, you can invest your money in shares or bonds. To increase your income, you could purchase property.

You can use a wealth manager to look after your money. You won't need to worry about making sure your investments are safe.

How does wealth management work?

Wealth Management involves working with professionals who help you to set goals, allocate resources and track progress towards them.

Wealth managers are there to help you achieve your goals.

They can also be a way to avoid costly mistakes.

How To Choose An Investment Advisor

The process of selecting an investment advisor is the same as choosing a financial planner. There are two main factors you need to think about: experience and fees.

It refers the length of time the advisor has worked in the industry.

Fees are the cost of providing the service. These costs should be compared to the potential returns.

It's crucial to find a qualified advisor who is able to understand your situation and recommend a package that will work for you.

Who Should Use a Wealth Management System?

Anyone looking to build wealth should be able to recognize the risks.

New investors might not grasp the concept of risk. Poor investment decisions can lead to financial loss.

The same goes for people who are already wealthy. They might feel like they've got enough money to last them a lifetime. However, this is not always the case and they can lose everything if you aren't careful.

As such, everyone needs to consider their own personal circumstances when deciding whether to use a wealth manager or not.

How do I get started with Wealth Management?

You must first decide what type of Wealth Management service is right for you. There are many Wealth Management options, but most people fall in one of three categories.

-

Investment Advisory Services – These experts will help you decide how much money to invest and where to put it. They offer advice on portfolio construction and asset allocation.

-

Financial Planning Services- This professional will assist you in creating a comprehensive plan that takes into consideration your goals and objectives. Based on their professional experience and expertise, they might recommend certain investments.

-

Estate Planning Services: An experienced lawyer will advise you on the best way to protect your loved ones and yourself from any potential problems that may arise after you die.

-

Ensure that a professional is registered with FINRA before hiring them. You don't have to be comfortable working with them.

Where to start your search for a wealth management service

When searching for a wealth management service, look for one that meets the following criteria:

-

Has a proven track record

-

Locally based

-

Free consultations

-

Supports you on an ongoing basis

-

Clear fee structure

-

Excellent reputation

-

It is easy to contact

-

Customer care available 24 hours a day

-

A variety of products are available

-

Low fees

-

Does not charge hidden fees

-

Doesn't require large upfront deposits

-

You should have a clear plan to manage your finances

-

A transparent approach to managing your finances

-

Allows you to easily ask questions

-

You have a deep understanding of your current situation

-

Understand your goals and objectives

-

Is willing to work with you regularly

-

Work within your budget

-

A good knowledge of the local market

-

We are willing to offer our advice and suggestions on how to improve your portfolio.

-

Is available to assist you in setting realistic expectations

What Are Some Benefits to Having a Financial Planner?

A financial plan gives you a clear path to follow. It will be clear and easy to see where you are going.

It provides peace of mind by knowing that there is a plan in case something unexpected happens.

Financial planning will help you to manage your debt better. If you have a good understanding of your debts, you'll know exactly how much you owe and what you can afford to pay back.

Your financial plan will protect your assets and prevent them from being taken.

Statistics

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

- Newer, fully-automated Roboadvisor platforms intended as wealth management tools for ordinary individuals often charge far less than 1% per year of AUM and come with low minimum account balances to get started. (investopedia.com)

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

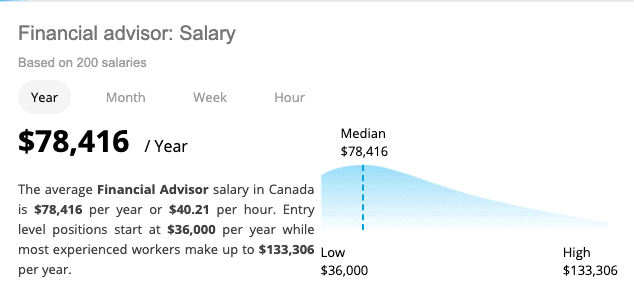

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

External Links

How To

How to beat inflation using investments

Inflation can be a major factor in your financial security. Over the last few years, inflation has been steadily increasing. The rate of increase varies across countries. For example, India is facing a much higher inflation rate than China. This means that your savings may not be enough to pay for your future needs. You could lose out on income opportunities if you don’t invest regularly. So, how can you combat inflation?

Stocks are one way to beat inflation. Stocks provide a good return-on-investment (ROI). You can also use these funds for real estate, gold, silver, and any other asset that promises a higher ROI. But there are some things that you must consider before investing in stocks.

First of all, choose the stock market that you want to join. Do you prefer small or large-cap businesses? Then choose accordingly. Next, consider the nature of your stock market. Do you want to invest in growth stocks or value stock? Then choose accordingly. Learn about the risks associated with each stock market. There are many stocks on the stock market today. Some are dangerous, others are safer. You should choose wisely.

Take advice from experts if your goal is to invest in stock markets. They will be able to tell you if you have made the right decision. If you are planning to invest in stock markets, diversify your portfolio. Diversifying your investments increases your chance of making a decent income. If you only invest in one company, then you run the risk of losing everything.

If you still need help, then you can always consult a financial advisor. These professionals will guide you through the process of investing in stocks. They will guide you in choosing the right stock to invest. They can help you determine when it is time to exit stock markets, depending upon your goals and objectives.